Little Known Facts About Conflict-Free Financial Planning.

We created our Resource mainly because acquiring an advisor could be tricky. A great advisor can present you with fantastic assurance; keeping away from these 7 blunders could help you save you many years of pressure. Scroll down for the listing.

Like I try to remember Jackson National experienced an extremely simple, uncomplicated merchandise. It paid a couple per cent. It experienced a really uncomplicated formulation. Everybody understood what they ended up acquiring. We got compensated a bit to apply it.

Particularly as both of those exercise designs and fiduciary criteria evolve, the dialogue of what it means to perform the best detail as being a fiduciary is a vital dialogue for your financial products and services sector in general to possess.

You may as well press for alter. Mediocre 401(k) designs can recover. Employers usually are the fiduciary having a lawful duty to consider just the desire of individuals, and it’s in their own ideal interest to just take your misgivings under consideration.

Authors like Helaine Olen happen to be correct on the mark in indicating the financial providers business and employers are all far too wanting to inform us how little we are conserving, however You should not function sincere brokers in maximizing our retirement savings.

I’m not indicating AUM advisors are criminals – I’m saying that for my target clientele, and my follow, mounted cost was the most suitable choice.

Choosing an advisor who YOURURL.com is not a fiduciary suggests they could propose decisions That won't be in your finest interest.

Tax-deferred accounts are ideal if you believe you'll be in a decreased earnings tax bracket in retirement than that you are nowadays. Contributions to Roth accounts, on the other hand, will not reduce your taxable profits that year, but then there's no need to spend official statement taxes on distributions in retirement. They seem to be a better choice if you're thinking that you might be within a decreased earnings tax bracket now than you're going to be in retirement.

He is invested entirely in a very goal day fund designed up of actively managed mutual money which have lagged the overall market’s returns in the previous decade. The fund prices an yearly expenditure price of just above one %.

Achieve real estate property investing with demonstrated toolkits which have assisted A huge number of aspiring and current investors attain financial freedom.

To receive a duplicate of your whitepaper, remember to home Call compliance@smartasset.com. The value of Specialist expense tips is barely an illustrative estimate and varies with Every single unique consumer's specific instances and portfolio composition. Very carefully look at your expense goals, danger aspects, and conduct your have due diligence prior to deciding on an financial investment adviser.

Provided these 3 positive explanations for making use of your company retirement price savings software, regardless of whether or not it's a 401(k) or 403(b) or another thing that is similar, why wouldn’t a prudent human being soar appropriate on board?

Embrace your 401(k) and it find out here now will get you destinations; like an unique Beach front someplace in paradise where you won’t Have a very care in the world.

Use of third party company logos isn't going to Get More Information indicate any affiliation with or endorsement by Individuals companies. Beagle Commit, LLC reserves the ideal to restrict or revoke any and all presents at any time.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Charlie Korsmo Then & Now!

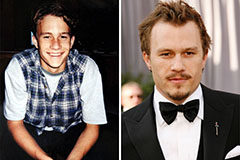

Charlie Korsmo Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!